The CBIC has recently introduced Form PMT-09 for transfer of amount from one head to another head in the electronic cash ledger. This enables a registered taxpayer to transfer any amount of tax, interest, penalty, etc. that is available in the electronic cash ledger, to the appropriate tax or cess head under IGST, CGST and SGST in the electronic cash ledger.

Hence, if a taxpayer has wrongly paid CGST instead of SGST, he can now rectify the same using Form PMT-09 by reallocating the amount from the CGST head to the SGST head.

Key points to note about Form GST PMT-09:

• If the wrong tax has already been utilized for making any payment, then form PMT-09 is not useful. This Form only allows the transfer of the amounts that are available in the electronic cash ledger.

• For instance, in case an amount has been misreported in the GSTR-3B, there is no way to rectify the same as the GSTR-3B is non-editable. In such a case, only an adjustment in the next month’s return can be made.

• The amount once utilized and removed from the cash ledger cannot be reallocated.

• Major head refers to- Integrated tax, Central tax, State/UT tax, and Cess.

• Minor head refers to- Tax, Interest, Penalty, Fee, and Others.

Filing Procedure of PMT-09

To file the GST PMT-09 on the GST Portal, perform following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

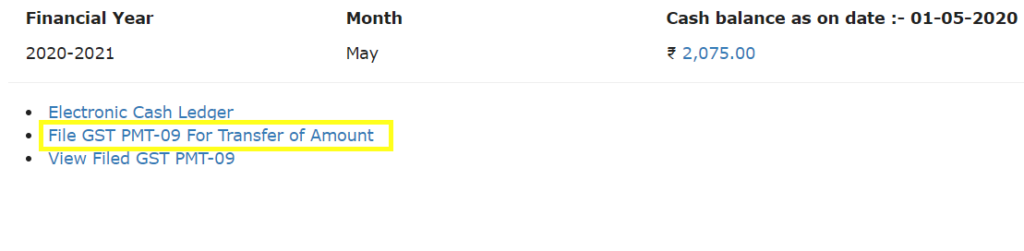

2. Click the Services > Ledgers > Electronic Cash Ledger.

3. Click on “File GST PMT-09 For Transfer of Amount’ , then the following window is displayed with following details:

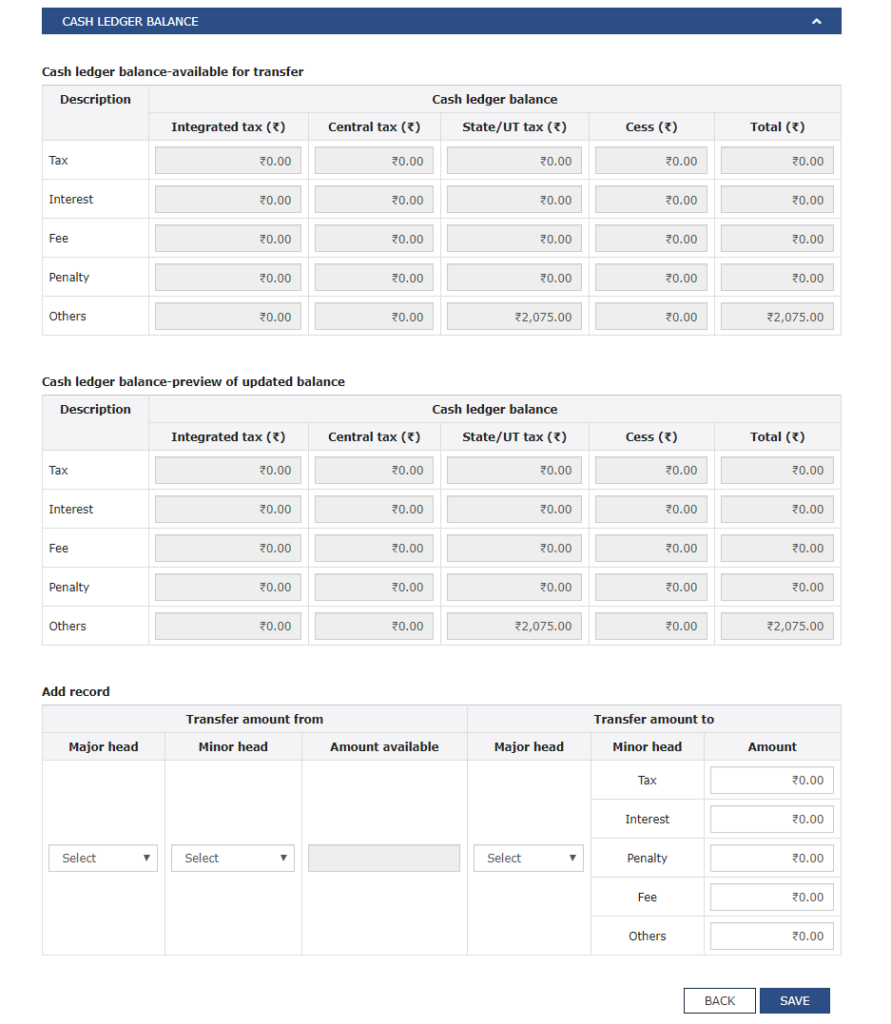

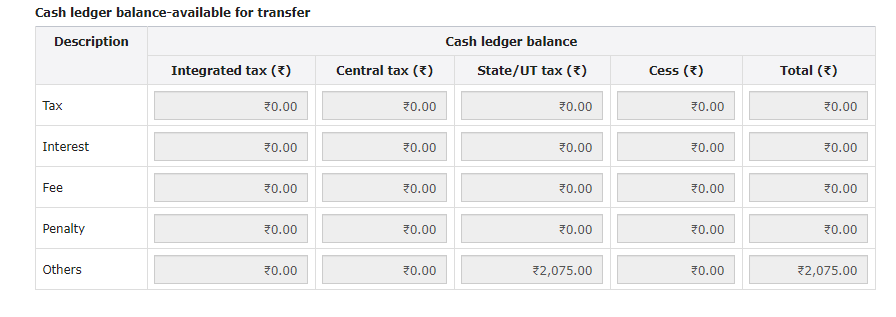

• Cash ledger balance-available for transfer:

In this table, we will able to view the balance available in an electronic cash ledger.

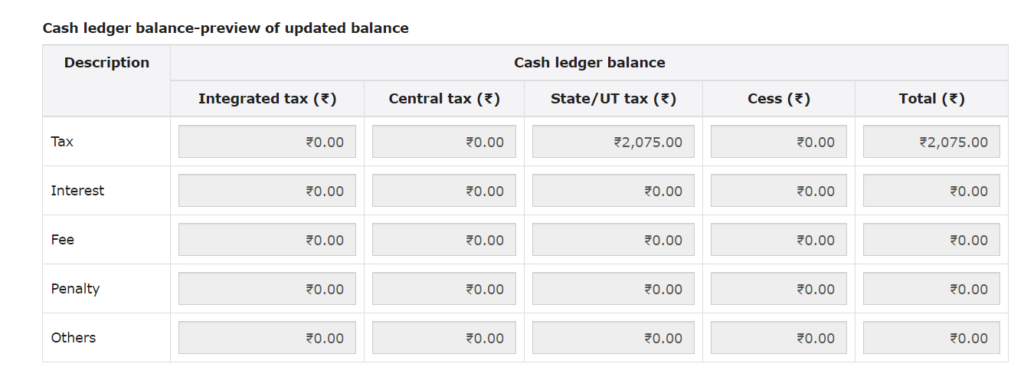

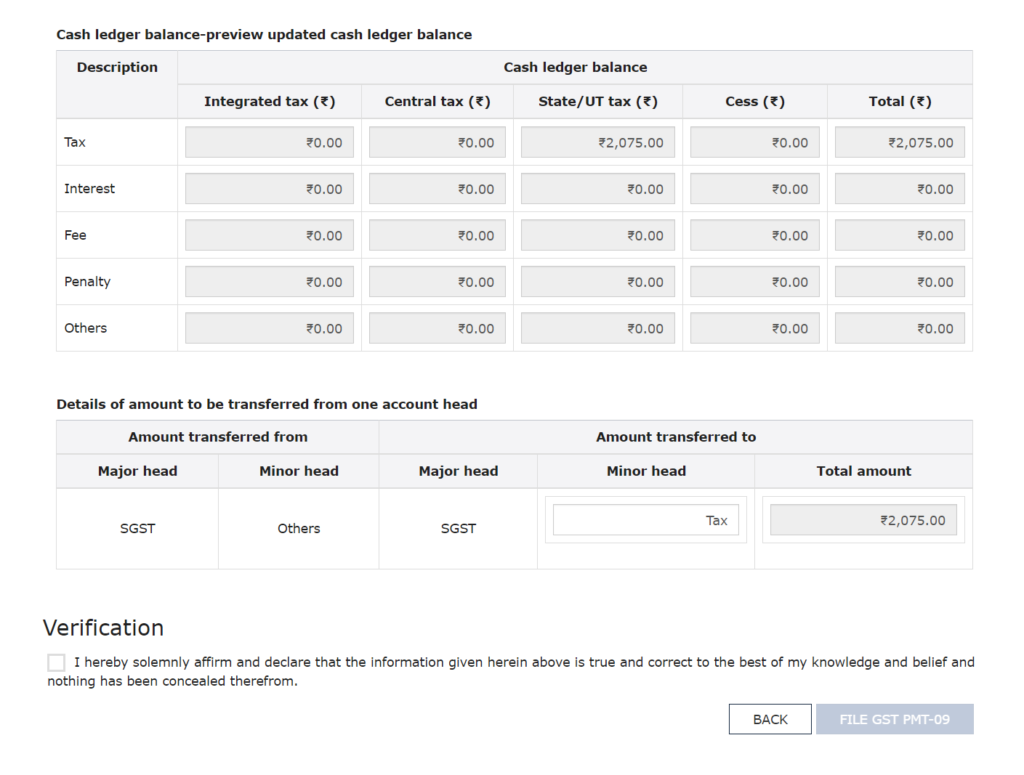

• Cash ledger balance-preview of updated balance:

In this table, we will able to view the updated balance of cash ledger after updating the details as per the requirement (Under Major head / Minor head).

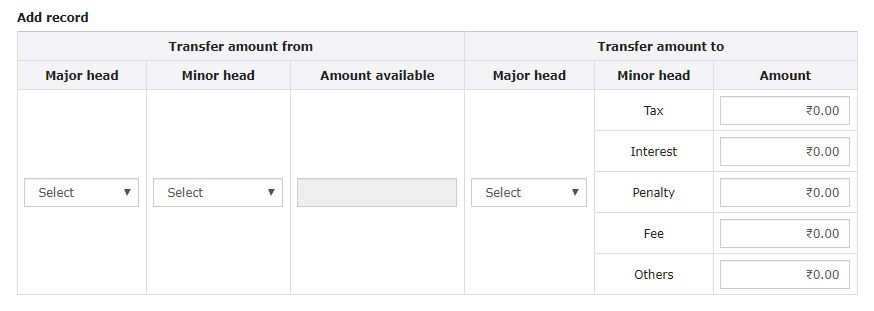

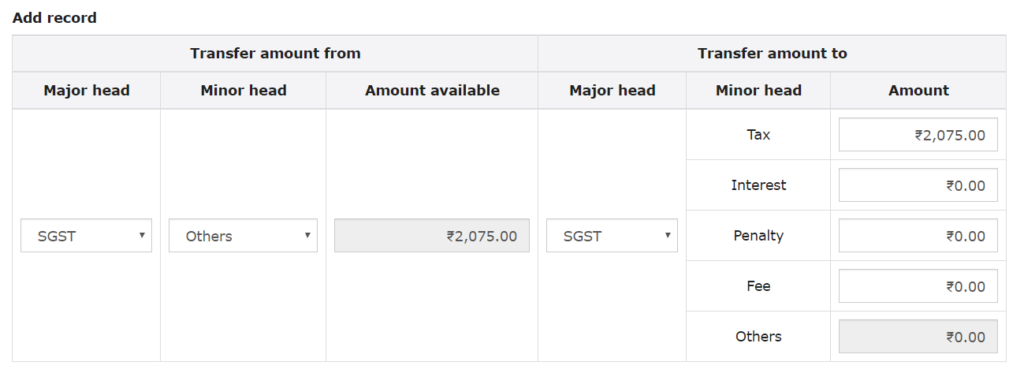

• Add record:

In this table, we will enter the details in “Transfer amount from’ and “Transfer amount to’ column as per the requirement.

4. We need to enter the details in “Add record’ table to proceed the Form PMT-09. Let’s discuss this with the help of an example.

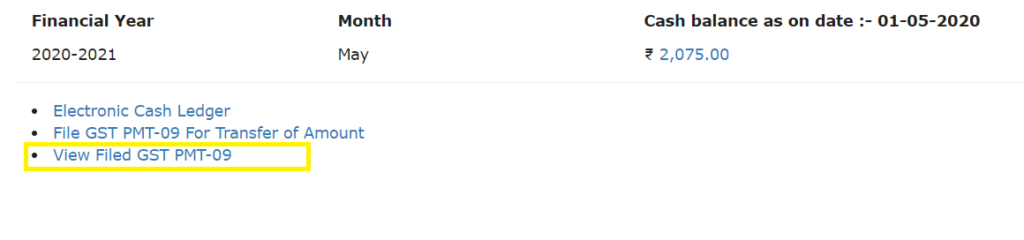

My electronic cash ledger balance is Rs. 2075 (under SGST) under others head and I need to transfer the SGST amount in same major head i.e. SGST but within another minor head i.e. tax. Let’s see with the help of a screenshot:

i. Please see my Cash ledger balance-available for transfer , where Rs. 2075 balance is reflected under others head.

ii. We will enter the details in “Add record’ table:

As per the example I need to transfer the others amount in tax head with same major head i.e. SGST.

The following details I have entered:

Transfer Amount From:

In this table, we need to enter the details of the head (Major, Minor and Amount available) from which amount needs to be transferred.

Transfer Amount to:

In this table, we need to enter the details of the head (Major, Minor and Amount) where we need to transfer the amount.

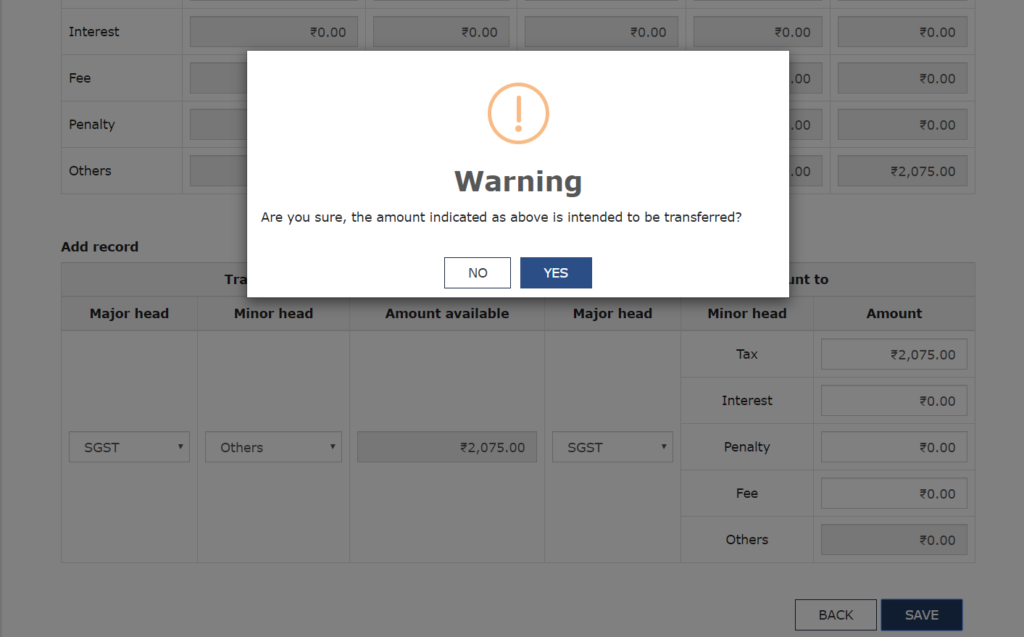

iii. After entering the details in add record, amount will get updated in Cash ledger balance-preview of updated balance after clicking on save tab.

* Updated balance of Rs. 2075 is reflected in SGST under tax head.

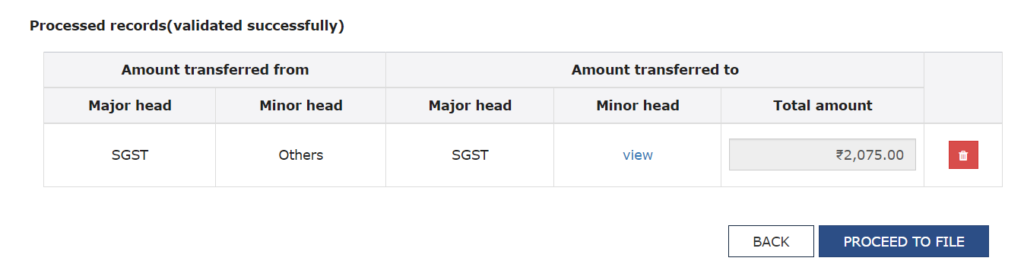

5. When we saved the details, the entered details will get reflected with processed records.

6. Click on “Proceed to file’, then following screen is displayed.

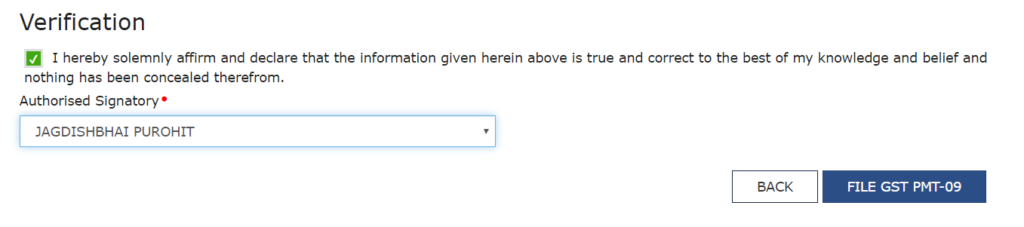

7. Click on declaration box and select the authorised signatory.

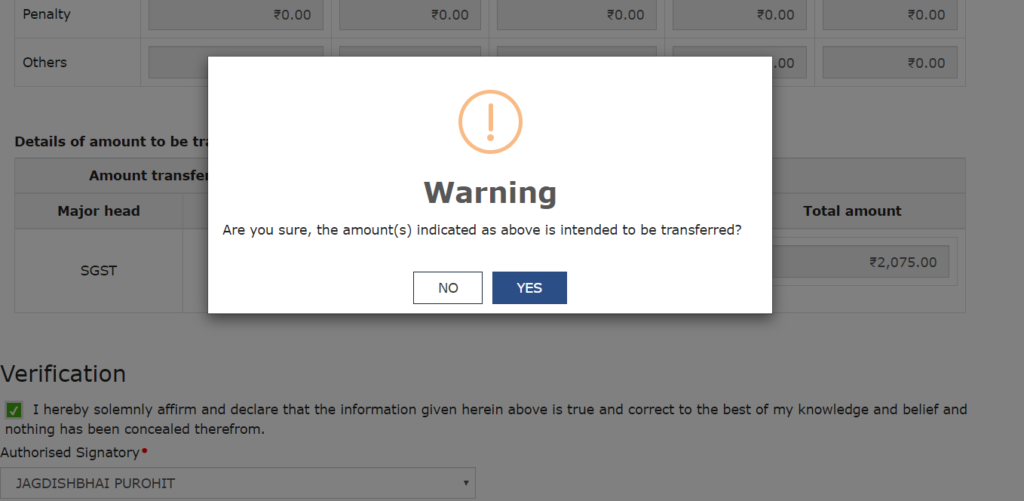

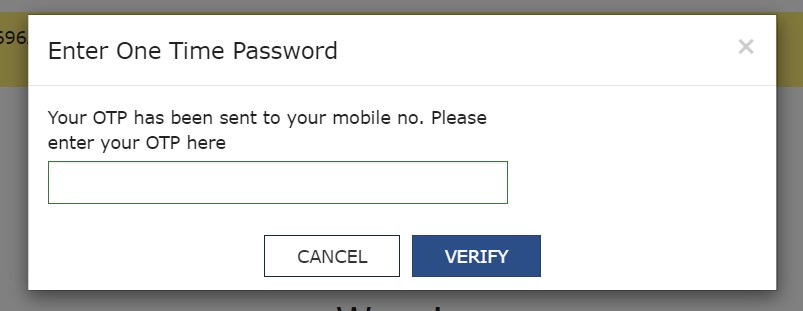

8. Click on “File GST PMT-09′ and enter the OTP.

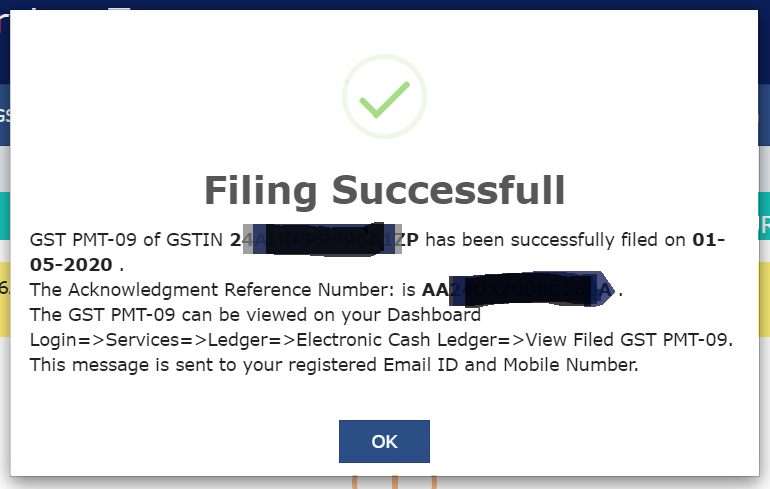

9. The success message is displayed and ARN will sent to your e-mail address and mobile phone number.

10. After successfully filing of PMT-09 , amount will get updated to cash ledger.

11. A taxpayer can also view the filed PMT-09 with the same path (Services > Ledgers > Electronic Cash Ledger).

I hope this article will help you to file the PMT-09. Please share your valuable views about the article.

Latest Posts:

- Why payments to supplier need to be done within 180 days! GST BIG BITE.

- CG liberalised the import policy of Low Ash Metallurgical Coke

- Opportunity of PH is must even if taxpayers has not filed reply of SCN

- Extension of timelines for filing of various reports of audit and Income Tax Returns (ITRs) for the Assessment Year 2025-26

- F&O Trading Loss? You Still Need to Report It!

- GST Updates applicable from 1st April 2025

- Advisory for furnishing bank account details by registered taxpayers under Rule 10A of the Central Goods and Services Tax Rules, 2017.

- SPEECH OF INTERIM BUDGET 2024

- The Updated GST Act(s) and Rules(s) – Bare Law, (January – 2024).

- Section 43B(h) : Disallowance of unpaid due of Micro and Small Enterprises